| All Systems Go in the Wind Business |

|

| Thursday, April 30, 2009 | |

Page 3 of 3

Spanish turbine manufacturer Gamesa has established nine production centers in the last couple of years, four of them in the U.S. and four in China. In January 2008, Acciona, both a wind farm developer and a turbine manufacturer, opened its first production facility in the United States. In March 2008, the Danish turbine leader Vestas opened its first U.S. manufacturing facility, a blade factory, in Boulder, Colo., with additional plans to build the world’s largest tower factory there “in spite of the uncertainty surrounding the extension of the PTC scheme.” The 2.5-MW turbines to supply Nordex’s U.S. contracts in 2008 and 2009 are largely being assembled in Germany. However, over the next few years, Nordex will be spending around $100 million to establish its own U.S. production facilities, and over the next four years aims to generate around 20% of sales in North America. Some turbine manfacturers have pursued vertical integration from the start, notably Suzlon Energy and Gamesa. Suzlon purchased Hansen Transmissions in 2006 for €465 million; in earlier deals, Siemens acquired Flender and Winergy (gearboxes) and Vestas purchased Weier Electric. By contrast, Nordex’s approach to components supply has been to let market forces reign rather than acquire or invest in the supply chain. “The market has proved us right,” claimed Losada, who noted that many new component suppliers have appeared on the market, and established suppliers have invested in expanding their capacity. The first Chinese manufacturers expected to enter the international market are Goldwind and Sinovel in 2009 and 2010. Testing organization Germanischer Lloyd said it is certifying the design of Sinovel’s 3-MW turbine. A few Chinese companies have entered the wind energy business through licensing agreements. A-Power Energy Generation in January 2008 announced that its subsidiary Liaoning GaoKe Energy Group had licensed technology from Norwin of Denmark and Fuhrlander of Germany. It said its 750 kW Norwin wind turbine was expected to sell for $0.46 to $0.51 million, and its 2.5-MW Fuhrlander wind turbine for $2.7 to $3.2 million, with 8% to 12% gross margins. According to a report from The Climate Group, a non-profit organization, China will become the world’s leading manufacturer of wind turbines by 2009. Vestas’s decline in global marketshare from 28% in 2006 to 23% in 2007 was attributed to competition from China’s domestic manufacturers. - Adapted from Climate Change Business Journal, August/September 2008 |

Submitted by Singapore

AIM

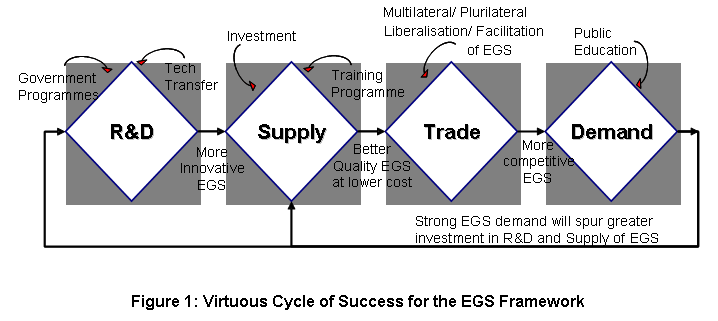

This paper seeks CTI's endorsement on a work programme framework for environmental goods and services (EGS) in APEC.

...

Submitted by Singapore

AIM

This paper seeks CTI's endorsement on a work programme framework for environmental goods and services (EGS) in APEC.

...